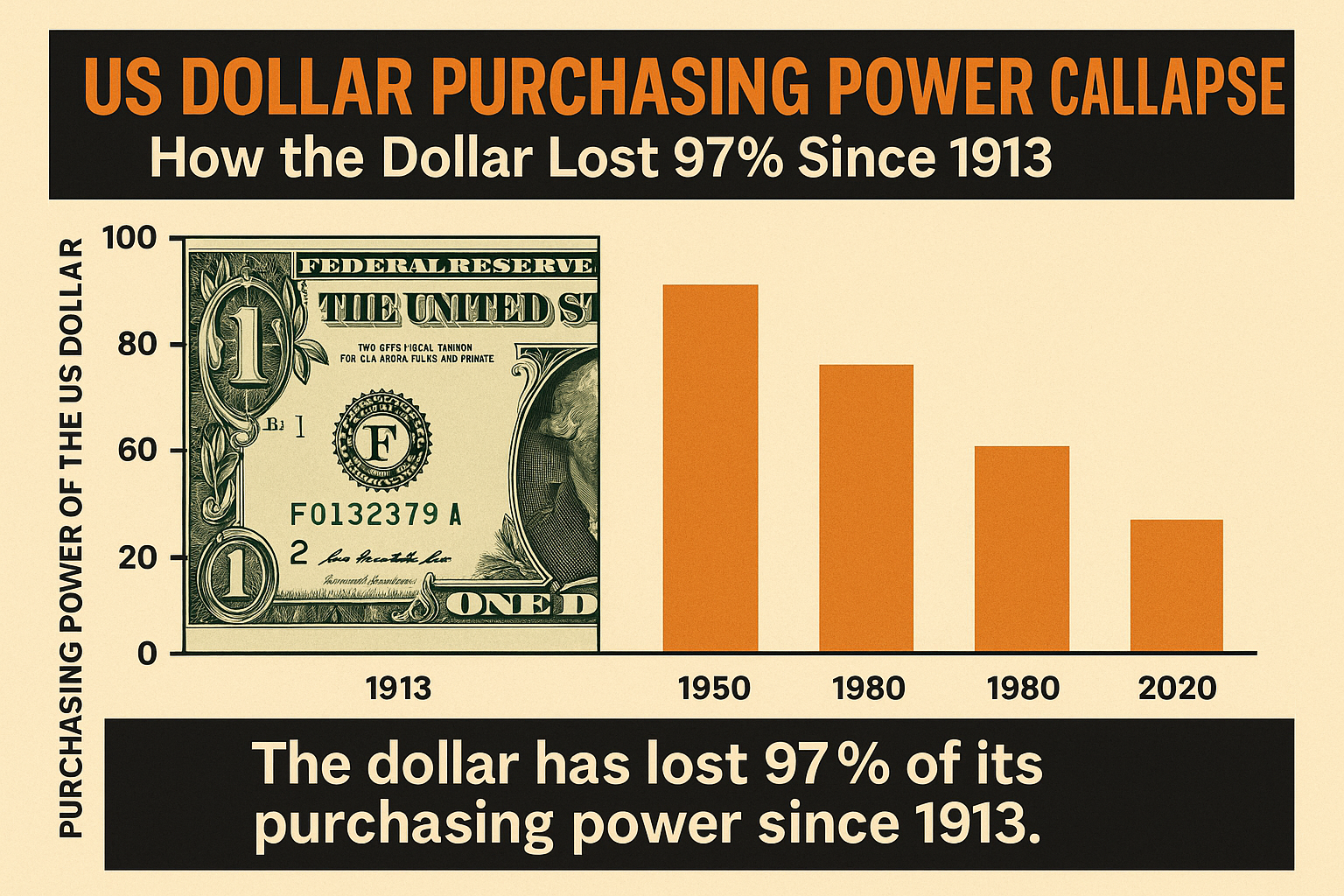

US dollar purchasing power has become one of the most important economic topics today. While the U.S. dollar is still considered one of the strongest currencies worldwide, its long-term value tells a different story. According to historical data from the U.S. Bureau of Labor Statistics (DoFollow link: https://www.bls.gov/data/inflation_calculator.htm), the dollar has lost 97% of its purchasing power since 1913, the same year the Federal Reserve was created. Something that cost $1 in 1913 now costs around $30, showing how inflation has silently reshaped American life.

This decline didn’t happen suddenly. It is the result of decades of monetary policies, economic downturns, wars, global crises, and continuous expansion of the money supply. Understanding this history is essential because it shows how inflation affects our income, savings, investments, and overall financial future.

Table of Contents

US Dollar Purchasing Power and the Rise of Inflation

The story begins with inflation — the steady rise in prices over time. Inflation reduces the value of every dollar in your wallet. Each time prices increase, your money buys less. The creation of the Federal Reserve in 1913 marked the start of a new financial system in the United States. Over the decades, the government responded to major events such as the Great Depression, World War II, the oil crisis, the 2008 financial crash, and the 2020 pandemic by dramatically increasing the money supply.

When more money enters the system, each existing dollar becomes weaker. This long-term trend is the primary reason behind the decline in US dollar purchasing power, and it continues today.

The Federal Reserve’s Role in the Decline

The Federal Reserve uses tools like interest rate adjustments and money creation to stabilize the economy during recessions. While this helps in the short term, it also increases overall inflation. Whenever the Fed prints new money, the value of existing dollars decreases.

Historical money-supply data shows that the U.S. has dramatically expanded the amount of dollars in circulation in recent decades, especially after the 2008 crisis and during the 2020 pandemic. This rapid expansion explains why prices today are much higher than in previous generations — not because products suddenly became valuable, but because the dollar became weaker.

How the Decline Affects Everyday Americans

The loss of US dollar purchasing power affects every household. The impact is visible in almost every expense Americans face:

- Groceries cost far more than they did 10 or 20 years ago

- Rent and home prices have risen dramatically, outpacing wages

- Healthcare and education continue to climb

- Savings lose value over time unless invested carefully

Even if incomes rise, inflation often rises faster. This creates the feeling that people “work more but get less.” That feeling is not wrong — it is a direct result of weakened purchasing power.

Why the Dollar Still Seems Strong

Despite its decline at home, the U.S. dollar remains the world’s most powerful reserve currency. Countries use it for global trade, financial markets, and commodity pricing. This gives the dollar tremendous international influence.

However, global strength does not protect the dollar from domestic inflation. A currency can dominate international markets while losing value at home — and that’s exactly what has happened over the last century.

The Future of the Dollar

As US dollar purchasing power continues to fall, more people are exploring alternative assets like gold, real estate, and Bitcoin as ways to protect their wealth. These assets cannot be created endlessly like fiat currency, making them popular hedges against inflation.

If inflation continues to rise or the money supply expands further, the dollar may lose even more purchasing power in the decades ahead. This makes financial education more important than ever for anyone planning their financial future.

Conclusion

The decline of US dollar purchasing power is not just a historical statistic — it is a reality that affects daily life. Inflation silently lowers the value of your savings, increases the cost of living, and reshapes the economy. Understanding why the dollar lost 97% of its value helps people make smarter financial decisions and prepare for a future where the purchasing power of money may continue to weaken.

External Resources (DoFollow Links)

U.S. Bureau of Labor Statistics

https://www.bls.gov/data/inflation_calculator.htm

Federal Reserve Education

https://www.federalreserveeducation.org

St. Louis Federal Reserve – Money Supply Data

https://fred.stlouisfed.org/series/M2SL

Inflation Calculator

https://www.in2013dollars.com

International Monetary Fund – Dollar Dominance

https://www.imf.org/en/Blogs/Articles/2022/03/24/the-dollar-dominance-and-international-roles-of-currencies

Investopedia – Inflation & Currency Value

https://www.investopedia.com

2 thoughts on “US Dollar Purchasing Power Collapse: How the Dollar Lost 97% Since 1913”