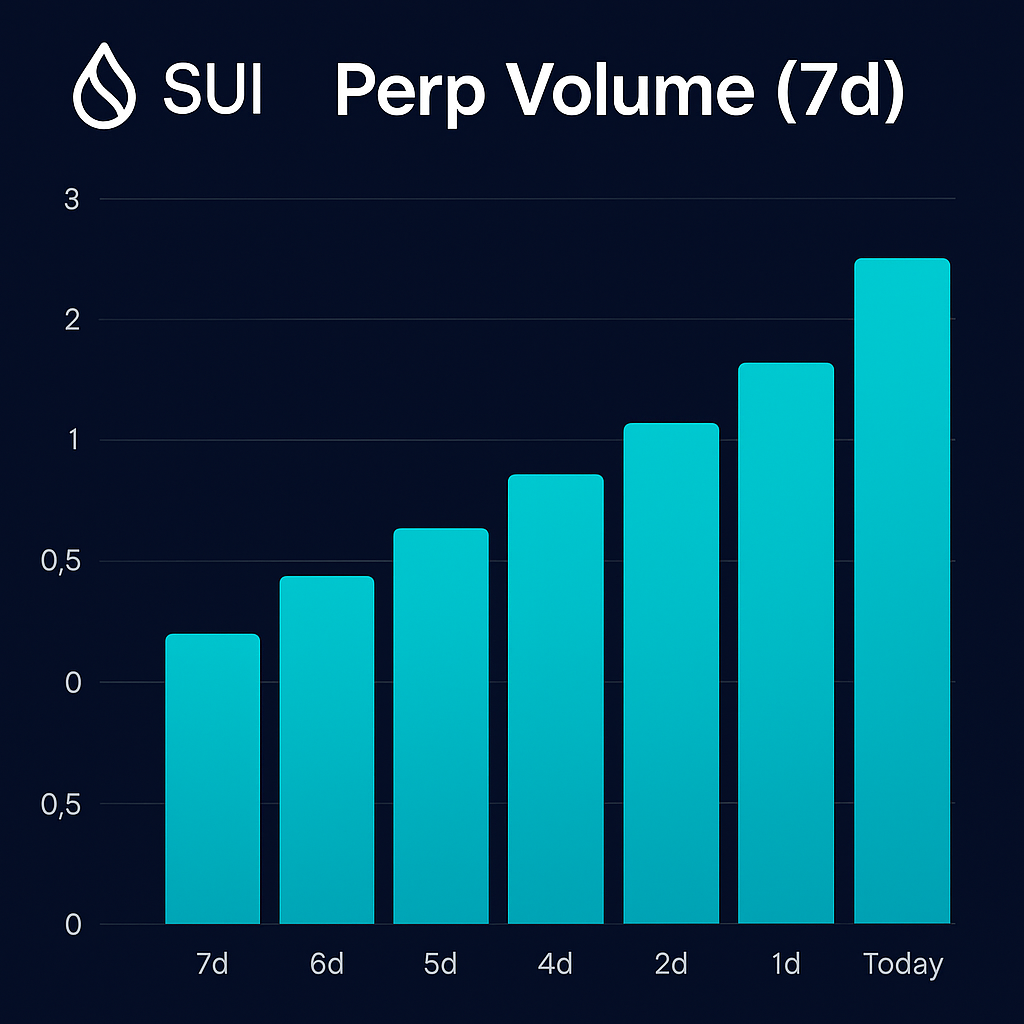

The SUI ecosystem is experiencing a major surge in derivatives trading activity. According to the latest market data, SUI Perpetual Futures Volume rose by an impressive 53% over the past seven days, signaling a renewed wave of institutional and retail interest in the rapidly expanding Layer-1 blockchain.

This growth highlights SUI’s strengthening position within the broader DeFi and derivatives markets, which are increasingly dominated by next-generation blockchains focused on scalability and low transaction costs.

“SUI is becoming a serious contender among Layer-1 ecosystems,” said analyst Michael K. from CoinMetrics. “Its perpetual markets show liquidity and user growth that mirror early Solana and Avalanche trends.”

Table of Contents

💹 1. What Is Driving the Surge in SUI Perpetual Futures Volume

The 53% surge in SUI Perpetual Futures Volume represents one of the largest weekly increases among major altcoins this quarter.

Analysts attribute the spike to three main factors:

- Increased liquidity inflows on major exchanges such as Binance, Bybit, and OKX.

- Growing developer activity and ecosystem expansion across DeFi and NFT protocols built on SUI.

- Rising speculation following strong performance in SUI’s total value locked (TVL) and on-chain transaction volume.

This momentum reflects both short-term trader activity and long-term investor positioning, suggesting broader belief in SUI’s fundamentals.

“The derivatives market doesn’t lie — when perpetual volume grows, it’s a reflection of real capital interest,” said Luna Analytics.

🏦 2. Institutional Adoption and Market Confidence

Another key driver behind the rise in SUI Perpetual Futures Volume is institutional participation.

Recent data shows that large trading desks and funds are increasingly opening long-term SUI exposure through perpetual contracts rather than direct spot purchases. This allows them to hedge risk while participating in SUI’s price discovery process.

In addition, several market-making firms have boosted liquidity support for SUI futures, resulting in tighter spreads and deeper order books — a critical step for attracting professional traders.

“The shift to more sophisticated derivatives is a natural sign of market maturity,” said blockchain strategist Emma Zhao. “SUI’s ecosystem now has both the retail and institutional pillars needed for growth.”

⚙️ 3. How SUI’s Ecosystem Strengthens Its Derivatives Market

The surge in perpetual volume is not happening in isolation. It’s closely tied to SUI’s robust ecosystem growth across decentralized finance (DeFi).

Key indicators include:

- TVL exceeding $450 million, with rapid expansion in lending and staking protocols.

- Integration of LayerZero and Axelar bridges, improving cross-chain liquidity.

- Growing developer base contributing to new DeFi and GameFi applications.

This foundation makes SUI’s token and its derivatives more attractive to traders seeking volatility and exposure to fast-moving blockchain projects.

“Every new app built on SUI drives more on-chain activity, and that liquidity naturally spills over into futures markets,” explained DeFi researcher Alex Nguyen.

💰 4. Impact on Price and Market Sentiment

While perpetual volume does not directly determine price, it often correlates with rising investor attention and volatility.

In the past week, SUI’s price rose approximately 11%, briefly touching new local highs. The open interest across futures platforms also increased by more than 40%, suggesting that traders are positioning for continued upside momentum.

At the same time, funding rates have remained neutral — a sign of balanced sentiment between bulls and bears.

“This type of volume expansion without overheating is exactly what healthy growth looks like,” noted crypto trader @AlphaSignal.

🚀 5. What This Means for SUI’s Future

The growing SUI Perpetual Futures Volume marks a pivotal moment for the project’s market evolution.

As its trading infrastructure matures, SUI is emerging as a serious competitor to Solana, Aptos, and Avalanche in both retail and institutional spaces.

If the trend continues, analysts expect SUI’s derivative volume to double within the next quarter, potentially making it one of the top 10 most traded altcoin perpetuals globally.

“SUI’s fundamentals are catching up to its hype,” said blockchain economist Peter L. “Sustained derivatives growth is the strongest proof of investor conviction.”

🧭 Conclusion: A Growing Power in the Crypto Derivatives Market

The SUI Perpetual Futures Volume spike underscores the project’s growing influence in crypto markets.

With strong on-chain fundamentals, expanding ecosystem partnerships, and rising institutional engagement, SUI is not just another Layer-1 token — it’s positioning itself as a core player in the next wave of decentralized finance.

As one analyst put it: “SUI isn’t chasing trends — it’s building its own momentum.”

Read more